28+ How much mortgage can we get

Compare Mortgage Options Calculate Payments. 36000 of gross income less fixed monthly expenses.

Free Personal Business Financial Plan Templates Excel Best Collections

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all.

. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income. Fill in the entry fields and click on the View Report button to see a. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad Were Americas Largest Mortgage Lender. Good Credit the lesser of. Lock Your Mortgage Rate Today.

Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. Medium Credit the lesser of. For example if your monthly mortgage payment with taxes and insurance is 1260 a month and you have a monthly income of 4500 before taxes your DTI is 28.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Another guideline to follow is your home should. According to this guideline your mortgage payment should be no more than 28 of your gross monthly income.

Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford. 42000 of gross. This ratio says that.

Apply Now With Quicken Loans. Ad Calculate mortgage rates - adjustable or fixed how much you might qualify for more. To determine how much you can afford using this rule multiply your monthly gross income by 28.

Ad Were Americas Largest Mortgage Lender. Apply for a mortgage or home equity loan with Hudson Valley Credit Union. 1260 4500 028 You.

A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment. Lock Your Mortgage Rate Today. To give you an idea - with a 20 deposit you could get a repayment mortgage of between 79000 to 140000.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Your total monthly housing expenses when you factor in your potential mortgage payment should not be greater than this percentage of your gross monthly income. 28000 of gross income or.

Or Refinance to Take Cash Out. Your housing costs including all the items listed above should. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today.

If you were to use the 28 rule you could afford a monthly mortgage payment of 700 a month on a yearly income of 30000. For example if you make 10000 every month multiply 10000 by 028 to get. Calculating How Much House You Can Afford With The 2836 Rule.

Ad You Could be Saving Hundreds by Refinancing Your Mortgage. Compare Mortgage Options Calculate Payments. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. This mortgage calculator will show how much you can afford. Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income.

The first step in buying a house is determining your budget. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership. In general you can afford a mortgage 2 to 25 times your gross annual income.

36000 of gross income or. Be aware that lenders look at. Ultimately your maximum mortgage eligibility.

Apply Now With Quicken Loans. While you may have heard of using the 2836 rule to calculate affordability the correct DTI ratio that lenders will use to assess how much house you can afford is 3643. Another good rule of thumb is your.

These figures can go higher or lower depending on who you speak to. How Much House Can I Afford Based on My Salary. The 2836 rule states that a borrowers monthly mortgage payment should not be more than 28 of their gross monthly.

Dont Wait Take Advantage of Todays Historically Low Rates While You Still Can.

Here Are 22 Diagrams For Anyone Who S Obsessed With Dessert Chocolate Cookie Recipes Cookies Recipes Chocolate Chip Perfect Chocolate Chip Cookies

Land Lord Rental Property Rental Property Management Free Property Rental Property

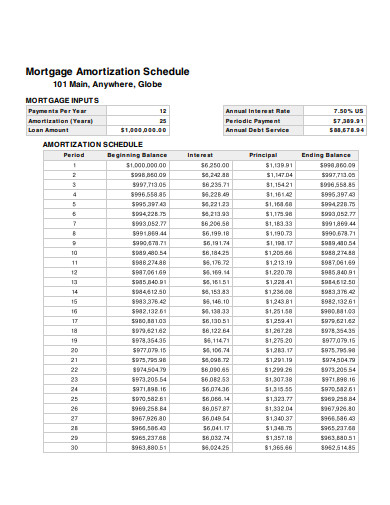

Tables To Calculate Loan Amortization Schedule Free Business Templates

11 Mortgage Amortization Schedule Templates In Pdf Doc Free Premium Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Illinois Appraisal Continuing Education License Renewal Mckissock Learning

28 Coffee Station Ideas Built Into Your Kitchen Cabinets Decor Snob Kitchen Design Trends Kitchen Design Home Decor Kitchen

Sample Letter Of Explanation For Mortgage Refinance Luxury Cash Out Letter Template Konusu Lettering Letter Templates Business Letter Template

31 Creative Blue Infographics Powerpoint Template On Behance Infographicsanimation Powerpoint Templates Business Infographic Powerpoint Design Templates

2

28 Ways To Save Money Each Month Hanfincal Com

0 Old Highway 50a Tract 1 Columbia Tn 38401 For Sale Mls 2429613 Re Max

Total Debt Service Ratio Explanation And Examples With Excel Template

Loan Servicing How Does Loan Servicing Work With Example

Total Debt Service Ratio Explanation And Examples With Excel Template

Sample Notice Of Default By Assignee To Obligor Free Fillable Pdf Forms Form Default Sample

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast By Sam Kwak David Bruce Paperback Barnes Noble